Major Updates in Income Tax Return (ITR) Forms – Last 15 Years

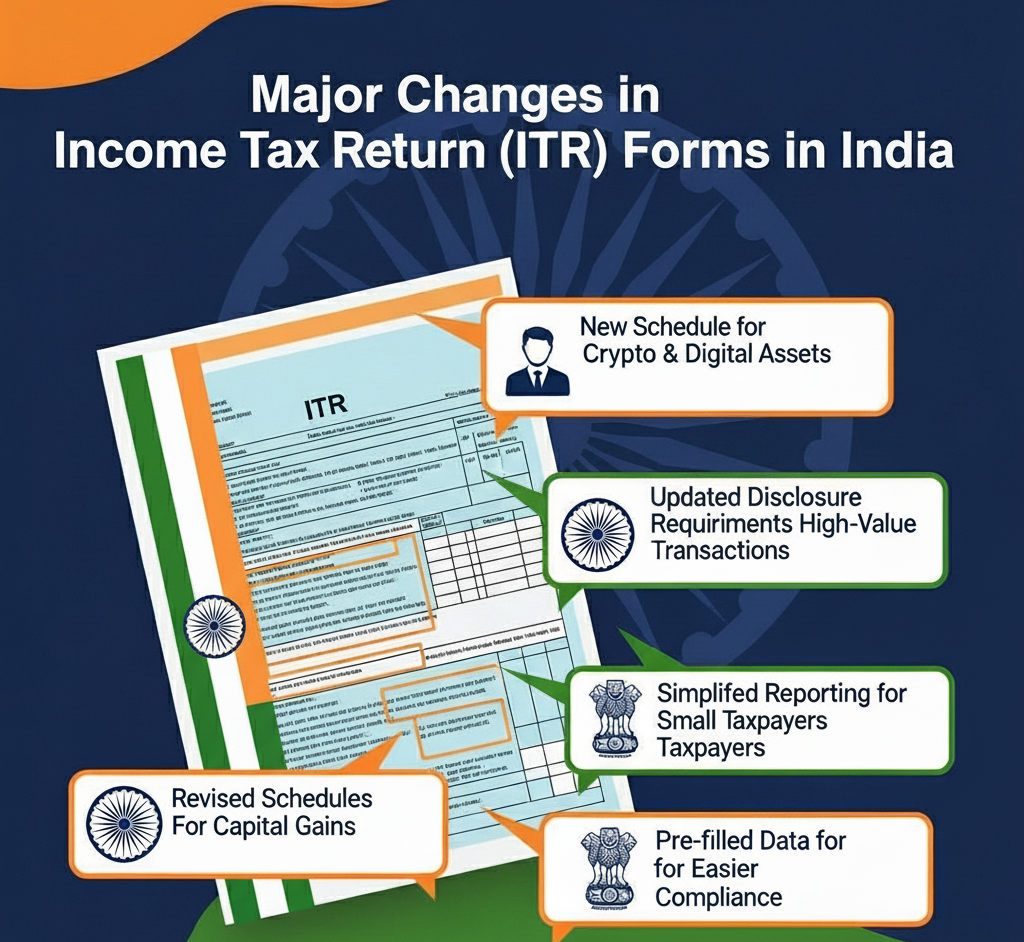

Recent BlogMajor Changes in Income Tax Return (ITR) Forms in India – Year-by-Year Key Updates (Last 15 Years)

|

Filing your income tax return is something most of us do every year, but the forms themselves have changed quite a bit over time! Let’s take a look at the major changes that happened in ITR forms over the past 15 years – so you can see how compliance has evolved, what new disclosures were introduced, and how the government made forms simpler (or more detailed!) over time. Here’s a year-by-year breakdown: |

| FY 2024–25 (AY 2025–26)

ITR-1 to ITR 4 have been released by the income Tax Department for A.Y. 2025-26. There are major changes that have been made by the Department. We have penned those changes that have been made by Department. The following changes are applicable for Old Regime. Now it is mandatory to report the following.

2. For 80C Deduction, now it is mandatory to report the Insurance Policy Number or Document Identification Number, /UAN (Universal Account Number) for EPF deduction under Section 80C. 3. For 80CCC/80CCD(1)/ 80CCD(1B) It is mandatory to report the PRAN (Permanent Retirement Account Number) of the Taxpayer in the income tax return. 4. For 80D Deduction: Health Insurance

5. For Section 80DD/ 80U Now requires the following:-

6. 80DDB Deduction Medical Treatment of specified Disease: Name of Specified Disease 7.80E Deduction: Interest on loan taken for higher education, now asks for the following additional disclosures

|

8. 80EE Deduction: Interest on loan taken for Residential House Property, now asks for the following additional disclosures

9. 80EEA Deduction: Interest on loan taken for Certain House Property, now asks for the following additional disclosures

|

10. 80EEB Deduction: Interest Paid on purchase of Electric Vehicle, now asks for the following additional disclosures

11. Section 10(13A) For those claiming House Rent Allowance (HRA) as an exemption, the following details are now mandatory:

|

12.Interest on Borrowed Capital/ Interest on Self-Occupied Property u/s Section 24(b), now asks for the following additional disclosures

|

|

|

| Key updates to ITR-2 for FY 2024–25 |

|

| Key updates to ITR-3 for FY 2024–25 |

|

| FY 2023–24 (AY 2024–25) |

These were the Key Changes that were introduced in FY 2023-24

|

When providing information about audits conducted under Section 44AB, including audit under Section 92E, companies were mandated to furnish the acknowledgment number of the audit report and the UDIN.

Section 43B of the Income Tax Act allows certain deductions only on actual payment, even for those using the mercantile system of accounting. The Finance Act 2023 added a new clause (h) to Section 43B. Now, any amount payable to a micro or small enterprise beyond the time limit specified in Section 15 of the MSME Act, 2006 will not be allowed as a deduction. Accordingly, the ITR forms incorporated a new column in Part A-OI (Other Information) to disclose such sums that remain unpaid beyond the allowed period.

Previously, taxpayers needed to mention only the amount deposited in the CGAS to claim exemptions on capital gains. |

For FY 23-24, Schedule CG in the ITR forms asked for these extra details:

This aimed to improve transparency around exemption claims. |

The Finance Act 2023 introduced Section 115BBJ to tax winnings from online games, effective from AY 2024–25. TDS on such winnings is covered under Section 194BA. Schedule OS in the ITR forms got a dedicated section to report these winnings separately. |

Section 80GGC allows deductions for donations to political parties or electoral trusts. FY 2023-24 ITR forms required more detailed reporting in Schedule 80GGC:

|

Employees of eligible startups can defer tax payment on ESOP perquisites. The ‘Schedule – Tax Deferred on ESOP’ asked for the following additional Information:

This improves monitoring of deferred tax obligations.

Section 80CCH was introduced for individuals enrolled under the Agnipath Scheme. They can claim a deduction for amounts deposited in the Agniveer Corpus Fund. FY 2023-24 ITR forms incorporated a dedicated field to report this deduction. |

Previously, the deduction under Section 80U was claimed in Schedule VI-A. FY 2023-24 ITR-3 included a separate Schedule 80U, asking for:

|

Section 80DD offers deductions for expenses incurred on medical treatment or insurance for a dependent with disability. A new Schedule 80DD got added, asking for:

|

The Finance Act 2023 reduced the tax rate on dividends from IFSC units to 10%. Schedule OS incorporated a specific column to report such income at the reduced rate. |

New rules tax certain sums received from high-premium life insurance policies under Section 56(2)(xiii). ITR forms included an extra column in Schedule OS to declare such bonus payments.

The Finance Act 2023 inserted Section 56(2)(xii) to tax certain sums received by unitholders of business trusts. Schedule OS included a new column to report such income, ensuring proper taxation.

Taxpayers were mandated to disclose all bank accounts held at any time during the year (excluding dormant accounts). This is required for better compliance and verification.

Under the concessional tax regime in Section 115BAC, unabsorbed additional depreciation cannot be carried forward. ITR forms incorporated the provision of this unabsorbed depreciation to be added back to the WDV of assets as on 01-04-2023 in Schedule DPM.

|

Startups claiming deduction under Section 80-IAC were mandated to fill a new schedule, providing:

Section 80LA offers deductions to offshore banking units and IFSC entities. The Schedule 80LA asks for:

Entities losing charitable status must pay tax on “accreted income” (the excess of FMV of assets over liabilities). Schedule 115TD now requires:

A new concessional tax regime for manufacturing co-operative societies was introduced. ITR-5 includes fields to declare:

|

| FY 2022–23 (AY 2023–24) |

These were the Key Changes that were introduced in FY 2022-23 and were applicable for all ITRs filed for FY 2022-23

Now split into: Advances from specified persons (Sec 40A(2)(b)) Advances from others.

|

| FY 2021–22 (AY 2022–23) |

| These were the Key Changes that were introduced in FY 2021-22 and were applicable for all ITRs filed for FY 2021-22

central govt, state govt, PSU, or others.

Must report: Assessment year of deferral Amount of deferred tax Tax payable in the current year Balance to be carried forward.

Introduced only for AY 2021–22 (COVID relief for late investments). For AY 2022–23 it was removed.

Enhanced matching with Form 26AS. Better fields for TDS on cash withdrawals (Section 194N).

Tax Regime choice ITR-1, 2, 3, 4: Confirm if taxpayer opts for old or new regime under Section 115BAC. |

| FY 2020–21 (AY 2021–22) |

| These were the Key Changes that were introduced in FY 2020-21 and were applicable for all ITRs filed for FY 2020-21

All receipts in cash during the previous year does not exceeds 5% of such receipts. · All payments in cash during the previous year does not exceeds 5% of such payments The ceiling limit for the A.Y 2020-21 was Rs.5 Crores as against Rs.10 Crores for the A.Y 2021-22 and hence necessary changes have been brought in the ITR forms to enhance the limit.

|

| FY 2019–20 (AY 2020–21) |

| These were the Key Changes that were introduced in FY 2019-20 and were applicable for all ITRs filed for FY 2019-20

Basic salary Perquisites Profits in lieu of salary Deductions u/s 16 Easier TDS verification with Form 16 and 26AS

Savings account interest Fixed deposit interest Other interest Goal: Better matching with TDS Form 26AS.

Days in India current year Days in preceding years Classification as Resident / RNOR / Non-Resident Purpose: To apply correct tax rules for NRIs.

PAN, name, share of ownership Purpose: Better cross-verification of property transactions.

Foreign bank accounts Financial interest in entities Immovable property abroad Foreign trusts Purpose: Compliance with Black Money Act disclosures.

First year taxpayers had to choose: Old regime (with deductions) New lower-tax regime (without deductions)

All forms Allowed Aadhaar to be quoted instead of PAN for filing. |

| FY 2018–19 (AY 2019–20) |

| These were the Key Changes that were introduced in FY 2018-19 and were applicable for all ITRs filed for FY 2018-19

Purpose: To strengthen identity verification and prevent duplicate PANs.

Purpose: Simplified and standardised deduction for employees.

Taxpayers had to report: ISIN Sale/purchase dates FMV on 31-Jan-2018 Cost and sale value. Reason: LTCG on equities was reintroduced in Budget 2018 after being tax-free for years.

PAN of buyer Address Share of ownership Amount

Agricultural income Dividend below ₹10 lakh Interest from tax-free bonds LTCG exempt under grandfathering. |

| FY 2017–18 (AY 2018–19) |

| These were the Key Changes that were introduced in FY 2017-18 and were applicable for all ITRs filed for FY 2017-18

Now taxpayers with one house property could declare rental income/loss in ITR-1. Simplified filing for salaried + 1 house owners.

Now included fields for: Salary income Income from one house property

Reason: Ensure NRIs provide complete foreign asset/income details.

Purpose: Reconcile ITR income with GST returns. Combat tax evasion.

Partners Members Trustees

Gross receipts Gross turnover Total expenses Net income Method of receipt (cash/digital)

Must report: Immovable property Jewellery Vehicles Bank balances Shares/bonds

All forms Aadhaar OTP, Net banking EVC, DSC. Easier online filing. |

| FY 2016–17 (AY 2017–18) |

| These were the Key Changes that were introduced in FY 16-17 and were applicable for all ITRs filed for FY 2016-17

The previous ITR 2A, ITR 2 and ITR 3 forms have been rationalized to single ITR 2 Form. The previous ITR 4 Form has been re-numbered as ITR 3.ITR 4S (Sugam) is now ITR 4 (Sugam).

ITR 1 Sahaj form which can be filled by tax payers who have income from salary/pension, one house property and income from other sources like interest income. However to fill this form the total income should be less than Rs 50 Lakhs. The form has done away with the long list of deductions and only included the most common deductions under section 80C, 80D, 80G and 80TTA. If the tax payer wants to claim tax benefit under other sections he can do so by mentioning relevant section in column titled “Any Other”. Some new columns have been introduced to report dividend income (u/s Section 10(34)) and exempted long term capital gains (u/s Section 10(38)).

Purpose:

Section 80C (LIC, PPF, etc.) Section 80D (health insurance) Section 80G (donations) Section 80TTA (savings interest) Section 80GGA (rural development donations)

All forms Taxpayers had to pre-validate their bank account in the e-filing portal to receive income tax refunds directly.

|

| FY 2015–16 (AY 2016–17) |

| These were the Key Changes that were introduced in FY 2015-16 and were applicable for all ITRs filed for FY 2015-16

New Schedule PTI introduced to report income received from: Business trusts Investment funds

Details to disclose: Name & PAN of trust/fund Nature/head of income Amount received Taxes withheld (if any) Purpose: Tax pass-through income in the same nature as in the hands of the trust.

New Schedule-TCS added to claim TCS credit. Taxpayers can now claim tax collected by sellers on: High-value cash purchases (e.g. jewellery over ₹5 lakh) Other specified transactions

Details required: Collector’s TAN Name of collector Amount collected Amount claimed

Purpose: Avoid previous confusion on how to claim TCS in returns.

New Schedule – ICDS added. Businesses must disclose adjustments to profits due to ICDS adoption.

Previously only for individuals and HUFs. Now Partnership firms (other than LLPs) can use it if:

|

| FY 2014–15 (AY 2015–16) |

| These were the Key Changes that were introduced in FY 2014-15 and were applicable for all ITRs filed for FY 2014-15

Verification possible through: Aadhaar OTP Net Banking Bank account/Demat EVC

No business/profession income No capital gains No foreign assets/income Meant for people with salary/pension + multiple house properties + other sources (excluding winnings). Purpose: Simplify filing for middle-class taxpayers with more than one house property.

But dormant accounts (inactive >3 years) were exempt from disclosure. Required details: IFSC code Account number

Instead of giving all foreign travel details and expenditure: Only Passport Number needed (if available). Forms affected: ITR-2, ITR-2A. Goal: Simplify compliance and privacy.

Mandatory e-filing if: Income > ₹5 lakh. Or any foreign income/foreign assets. Or seeking refund, even if income < ₹5 lakh. Goal: Move to paperless compliance.

Basic exemption limit increased: General taxpayers: ₹2.5 lakh Senior citizens: ₹3 lakh Very senior citizens (80+): ₹5 lakh. 80C limit raised to ₹1.5 lakh. Interest on home loan (Section 24) limit raised to ₹2 lakh (for self-occupied). Forms updated to capture these revised deductions. |

| FY 2013–14 (AY 2014–15) |

| These were the Key Changes that were introduced in FY 2013-14 and were applicable for all ITRs filed for FY 2013-14

|

| FY 2012–13 (AY 2013–14) |

| These were the Key Changes that were introduced in FY 2012-13 and were applicable for all ITRs filed for FY 2012-13

Foreign bank accounts Properties abroad Financial interests Signing authority in any foreign account

Basic salary Allowances Perquisites Deductions under section 16

Partner or shareholder info Nature of business Profit-sharing ratios.

|

| FY 2011–12 (AY 2012–13) |

| These were the Key Changes that were introduced in FY 2011-12 and were applicable for all ITRs filed for FY 2011-12

The CBDT amended the forms -ITR 2/3/4- wherein domestic and expatriate resident individuals have to make additional disclosures if foreign assets mentioned below which are held and located outside India:

Improved Forms for Firms and Companies ITR-5, ITR-6 Partner/shareholder details Profit-sharing ratios Nature of business.

Other Amendment in form ITR 2

|

| FY 2010–11 (AY 2011–12) |

| These were the Key Changes that were introduced in FY 2010-11 and were applicable for all ITRs filed for FY 2010-11

ITR -3:- This Return Form got notified to be used by an individual or an Hindu Undivided Family who is a partner in a firm and where income chargeable to income-tax under the head “Profits or gains of business or profession” does not include any income except the income by way of any interest, salary, bonus, commission or remuneration, by whatever name called, due to, or received by him from such firm. In case a partner in the firm does not have any income from the firm by way of interest, salary, etc. and has only exempt income by way of share in the profit of the firm, he shall use this form only and not Form ITR-2. ITR 4- This Return Form got notified to be used by an individual or an Hindu Undivided Family who is carrying out a proprietary business or profession and who are not filing Return under Presumptive Taxation Scheme. For Presumptive Business Income Assessee need to file Return in SUGAM (ITR-4S).

No need for full profit and loss details. |

| 📌 Final Thoughts

As you can see, over the last decade and a half the ITR forms in India have become more digital, more detailed, and more aligned with transparency goals. From Aadhaar linking to disclosures of foreign assets, from GST integration to new tax regimes — the forms have evolved to match India’s changing tax landscape. If you’re a taxpayer, it helps to know why these questions appear every year — they’re not just paperwork, they’re the government’s way of making tax compliance more accurate and fair. Because of these major reforms and compliance enforcement, India’s Direct Tax collection has gone up from 3,72,000 crores in F.Y. 2008-2009 to almost 24,00,000 crores in F.Y. 2023-2024 and number of filed returns has gone up from approx 3 crores in F.Y. 2008-2009 to almost 9 crores Income tax returns filed for F.Y. 2023-24. |